Ascending wedge how to#

Learn about cookies and how to remove them. Removal of cookies may affect the operation of certain parts of this website. This website uses cookies to obtain information about your general internet usage. App Store is a service mark of Apple Inc. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. Telephone calls and online chat conversations may be recorded and monitored.

Ascending wedge registration#

CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173727.

CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under registration number 154814. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.ĬMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If the potential reward is less than the risk, it will be more difficult to make money over many trades, since losses will be bigger than profits. For example, if the profit target is 1000 points above the entry, as in the chart below, then ideally, the difference between the entry stop-loss (risk) is 500 points or less. Ideally, the potential reward is twice as much as the risk. After establishing the entry, stop-loss and target, consider the profit potential that the trade offers.

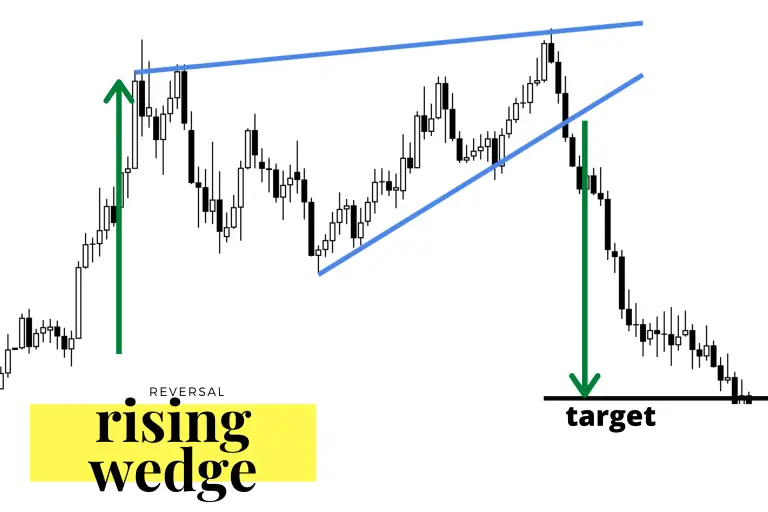

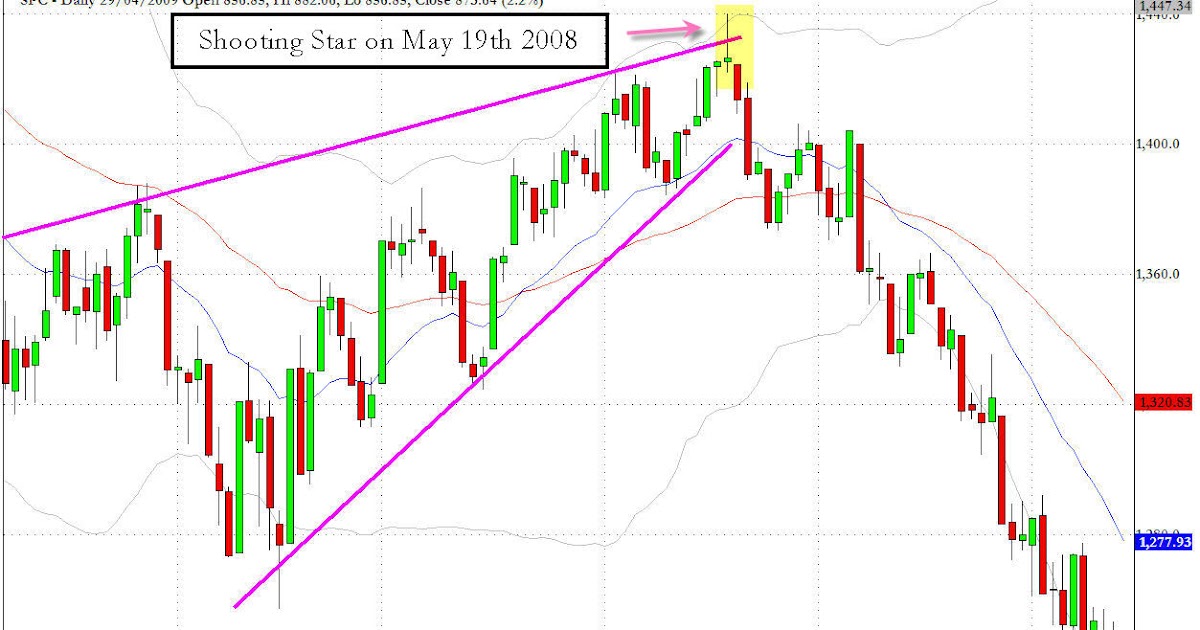

Risk-management is an important element of trading. Others may place the stop loss closer to keep the stop-loss size smaller. Some traders opt to place their stop-loss just outside the opposite side of the wedge from the breakout. This can provide another entry opportunity. Once the price has broken out, it will sometimes come back to retest the old trendline of the wedge.

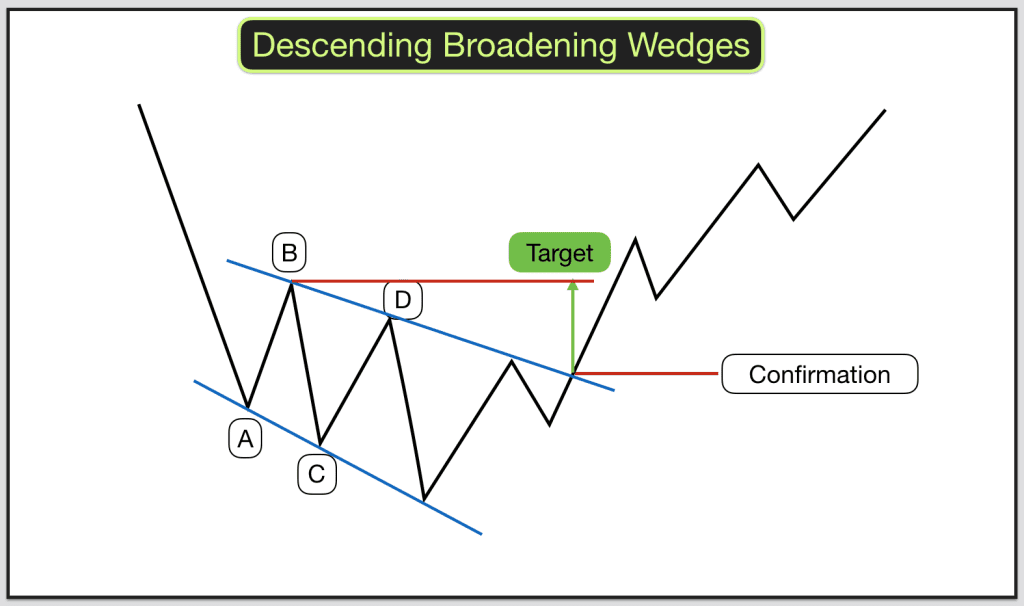

You could open a buy position if the price passes above the upper trendline of a descending wedge, or a sell position when the price falls below the lower trendline of an ascending wedge. Check the trendlines to make sure that you have drawn them to your liking (typically, they are drawn along, and connecting, swing highs and lows). Verify that the price has moved outside the wedge. This means the price moves outside the drawn wedge pattern. Draw trendlines along the swing highs and the swing lows to highlight the pattern.

0 kommentar(er)

0 kommentar(er)